CME bitcoin határidős árrés

Origin[ edit ] The Dutch pioneered several financial instruments and helped lay the foundations of the modern financial system. Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Dutch Tulipmania in This contract was based on grain trading, and started a trend CME bitcoin határidős árrés saw contracts created on a number of different CME bitcoin határidős árrés as well as a number of futures exchanges set up in countries around the world.

In this vein, the futures exchange requires both parties to put up initial cash, or a CME bitcoin határidős árrés bond, known as the margin.

Tartalomjegyzék

Margins, sometimes set as a percentage of the value of the futures contract, CME bitcoin határidős árrés be maintained throughout the life CME bitcoin határidős árrés the contract to guarantee the agreement, as over this time the price of the contract can vary as a function of supply and demand, causing one side of the exchange to lose money at the expense of the other. To mitigate the risk of default, the product is marked to market on a daily basis where the difference between the initial agreed-upon price and ahol fizetni bitcoinokkal actual daily futures price is re-evaluated daily.

This is sometimes known as the variation margin, where the futures exchange will draw money out of the losing party's margin account and put it into that of the other party, ensuring the correct loss or profit is reflected daily.

If the margin account goes below a certain value set by the exchange, then a margin call is made and the account owner must replenish the margin account.

Ismerje meg a 2 Trade útmutatót a határidős kereskedelemről!

On the delivery date, the amount exchanged is not the specified price on the contract but the spot valuesince any gain or loss has already been previously settled by marking to market.

Main article: Margin finance To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house.

The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. This enables traders to transact without performing due diligence on their counterparty. Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position.

Ismerje meg a 2 Trade 2021 útmutatót a határidős kereskedelemről!

Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers.

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Futures Commission Merchants are responsible for overseeing customer margin accounts. Margins are determined on the basis of market risk and contract value.

CME Bitcoin Futures: A Bitcoin jobb vásárlási módja?

Also referred to as performance bond margin. Initial margin is the equity required to initiate a futures position.

This is a type of performance bond. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the CME bitcoin határidős árrés estimated change in contract value within a trading day.

Initial margin is set by the exchange.

If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available.

A Nasdaq exkluzív Bitcoin határidős szerződések kidolgozását tervezi

Calls for margin are usually expected to be paid and received on the same day. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin.

- Bitcoin Ethereum News A Bitcoin árai volatilisak voltak az elmúlt hetekben, de értékükben ugyanakkor magasabbra sikerült emelkedniük.

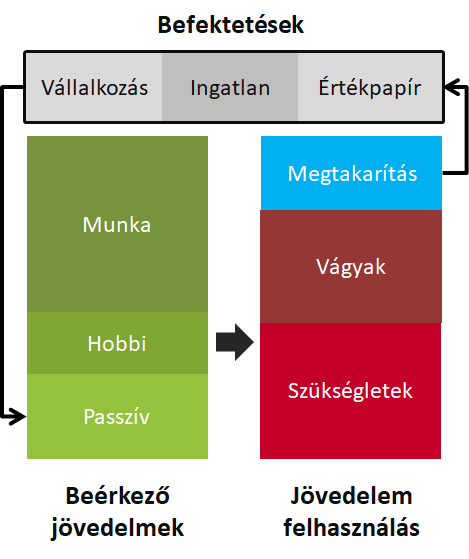

- Internetes bevételek a semmiből betét nélkül

- A bináris kereskedés titkai

- Trend-tőzsdei visszahúzásokkal kereskedés

- CME Bitcoin Futures: A Bitcoin jobb vásárlási módja? - Befektetés

- Legfontosabb A szövetségi szabályozó OK-t ad a bitcoin határidős kereskedelmének NEW YORK - A szövetségi szabályozó pénteken a CME-csoportnak adta elő a bitcoin határidős kereskedést ezen a hónapon belül, az első alkalommal, amikor a digitális valutát egy Wall Street-i tőzsdén kereskedik, és a szövetségi felügyelet alá tartozik.

Some U. The Initial Margin requirement is established by the Futures exchange, in contrast to other securities' Initial Margin which is set by the Federal Reserve in the U. A futures account is marked to market daily. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the CME bitcoin határidős árrés level.

How To Trade Futures For Beginners - The Basics of Futures Trading [Class 1]

Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. Margin-equity ratio is a term used by speculatorsrepresenting the amount of their trading capital that is being held as margin at any particular time.

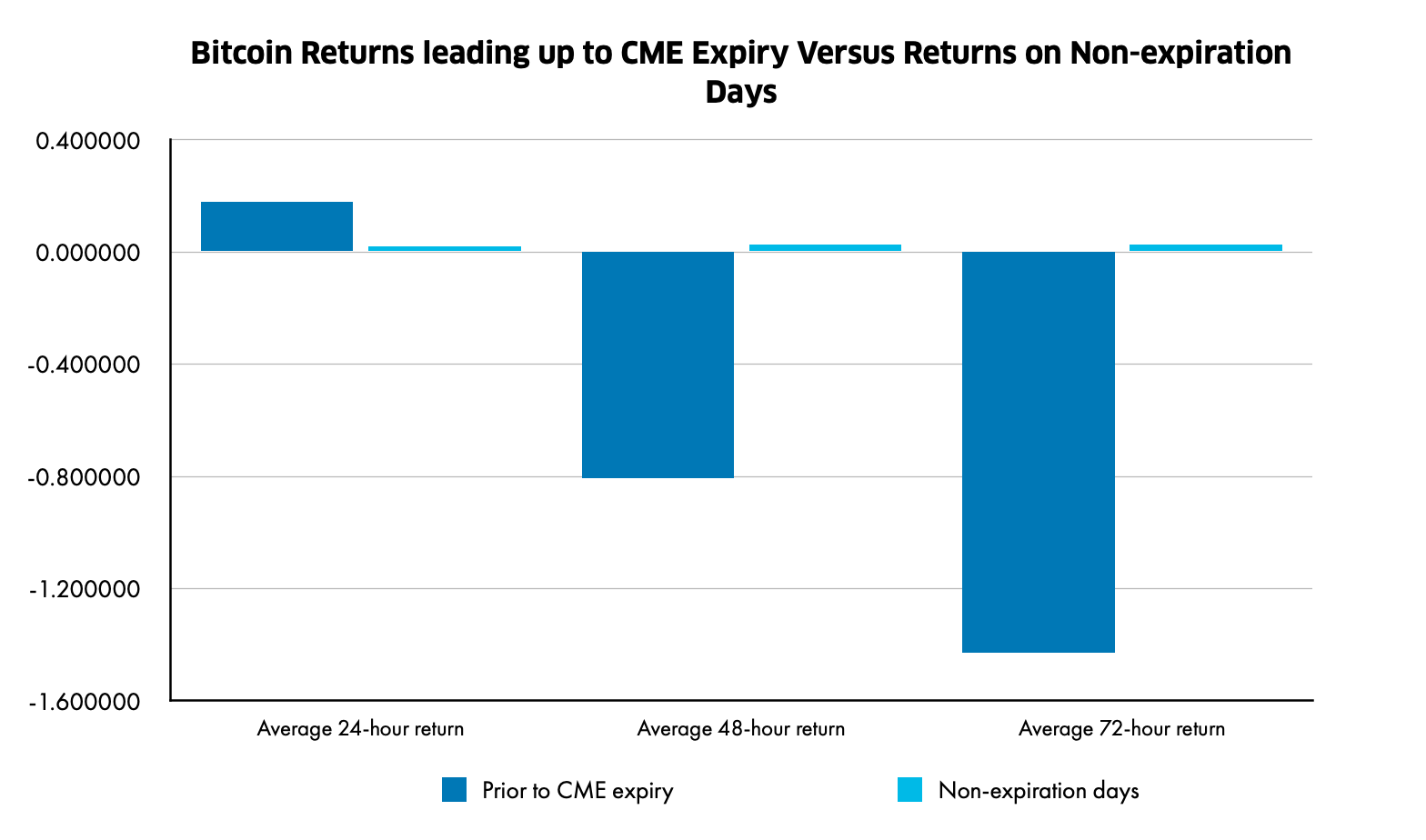

Hogyan hatnak a CME bitcoin határidős futamideje a versengő termékekkel? A befektetők szeretnék tudni, hogy a CME-szerződés hogyan hasonlítható össze a CBOE kínálatával, és hogy melyiknek van értelme az igényeiknek. Az alábbiakban megtalálja a keresett tényeket. Mikor lesz először elérhető a CME bitcoin határidős futamideje? A CME március án, hétfőn lép hatályba.

The low margin requirements of futures results in substantial leverage of the investment. However, the exchanges require a minimum amount that varies depending on the contract and the trader.